Learn how salaried employees, business owners, and middle-class families in India can create a 3-layer emergency fund strategy for financial security and peace of mind.

If the past few years have shown us anything, it’s that life doesn’t always stick to the plan. One moment everything’s fine, and the next bam! you’re hit with a medical bill, a job loss, or your car decides it’s done for the day. Emergencies don’t send calendar invites.

Take Rahul, a 32-year-old salaried employee in Pune. When his company downsized during the pandemic, he had to rely on credit cards and personal loans because he didn’t have enough savings set aside. The high interest rates left him financially stressed for months.

That’s where an emergency fund becomes a lifesaver. And not just any savings, but a 3-layer strategy that ensures you have money available at the right time, without derailing your long-term goals.

Let’s break it down.

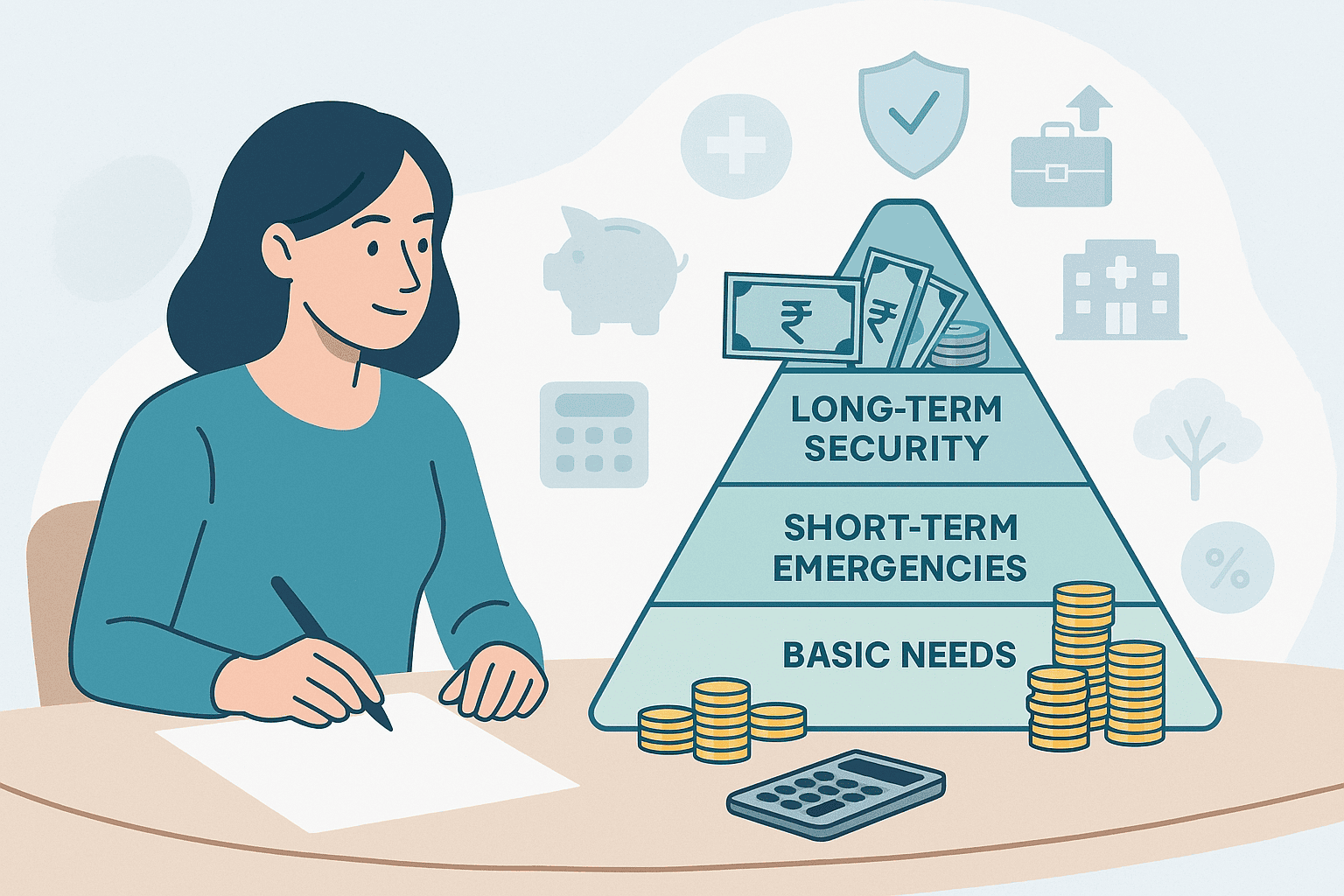

What is a 3-Layer Emergency Fund?

Think of it like an onion — multiple layers of protection. Instead of keeping all your emergency money in one place, you spread it across three “layers” based on accessibility, safety, and returns.

This way, you don’t lock away all your money (like in a fixed deposit), and you also don’t keep it all in cash (where inflation eats into it).

Layer 1: Instant Cash for Daily Emergencies

This is your first line of defence.

- Where to keep it: Savings account or UPI-linked bank account.

- How much: At least 1 month of expenses.

👉 Example: If your family spends ₹40,000 a month on essentials (rent, groceries, EMIs), then keep at least ₹40,000–₹50,000 liquid.

This is for those sudden events — like if your child falls sick at night and you need cash immediately, or if your bike breaks down on the way to work. You shouldn’t have to swipe a credit card for these.

Layer 2: Short-Term Safety Net (1–6 Months of Expenses)

This is your second line of defence, money you don’t touch unless the situation is bigger — like a job loss, health emergency, or unexpected travel.

- Where to keep it:

- Fixed deposits with auto-sweep facility.

- Liquid mutual funds (low risk, quick redemption within 24 hours).

- How much: 3–6 months of monthly expenses.

👉 Example: Ravi, a 35-year-old banker in Mumbai, sets aside ₹2.5–3 lakh in liquid funds because his monthly expense is around ₹50,000. If he ever faces a layoff, this fund will keep his family comfortable without panicking.

This layer gives you breathing room while you figure out the next steps in life.

Layer 3: Long-Term Buffer (6–12 Months of Expenses)

This is your final shield — rarely touched, but it exists for life-changing emergencies like long-term illness, business slowdown, or an extended period of unemployment.

- Where to keep it:

- Recurring deposits

- Low-risk debt mutual funds

- How much: 6–12 months of monthly expenses.

Example: Meera, a small business owner in Delhi, keeps around ₹5–6 lakh in a conservative debt fund. During the pandemic, when her shop was closed for almost 8 months, this fund kept her business and household running.

This layer ensures your family’s lifestyle doesn’t collapse when life throws its toughest challenges.

Why This 3-Layer Strategy Works

- Liquidity + Safety + Growth → You always have some cash at hand, some easily redeemable, and some growing quietly in the background.

- Peace of Mind → You don’t have to sell long-term assets like mutual funds or property in a hurry.

- No Debt Trap → You avoid high-interest loans and credit card bills during emergencies.

FAQs on Emergency Fund Strategy

1. How much total emergency fund should I keep?

A good rule is 6–12 months of expenses. Salaried employees can aim for 6 months, while business owners should plan for 12.

2. Should I keep my emergency fund in gold?

Not entirely. Gold is good as a hedge, but selling it during emergencies may not always fetch the right value. Use it only as part of Layer 3.

3. What if my salary is irregular (like freelancers or self-employed)?

Keep a higher buffer — at least 9–12 months of expenses. For freelancers, layering funds in liquid mutual funds and fixed deposits helps.

4. Can I use my PPF or EPF as an emergency fund?

Not really. These are long-term instruments with restrictions on withdrawal. Better to treat them as retirement savings, not emergency funds.

5. Do I need insurance if I already have an emergency fund?

Yes. Insurance (health, term, motor) and emergency funds go hand-in-hand. One doesn’t replace the other.

Conclusion

Building a 3-layer emergency fund strategy is like wearing a helmet, seatbelt, and having airbags — you hope you never need them, but if life hits you hard, you’ll be glad they’re there.

Whether you’re a salaried professional like Rahul, a businessman like Meera, or a freelancer juggling irregular income, this approach ensures you sleep better at night knowing you’re financially prepared.

Share this with a friend or colleague who keeps saying “I’ll save later”. Their future self will thank you.

Next on iMoneyMatters: We’ll explore “How to Balance Emergency Funds With Long-Term Investments Like Mutual Funds.” Stay tuned!

Related Reads on iMoneyMatters.in

- PPF Vs FD: Which One Should You Pick for Long-Term Savings?

- 4 Must-Have Insurance Policies Every Indian Should Consider

- How to Save Tax Smartly Using Section 80C Investments

Disclaimer

The content on iMoneyMatters.in is for educational and informational purposes only. It should not be considered as financial, investment, or tax advice. Readers are advised to do their own research and consult a SEBI-registered financial advisor before making any investment decisions