Next-Gen GST: India may soon move towards a single GST tax slab. Here’s what it means for salaried individuals, small businesses, and middle-class families, explained in simple terms.

Introduction

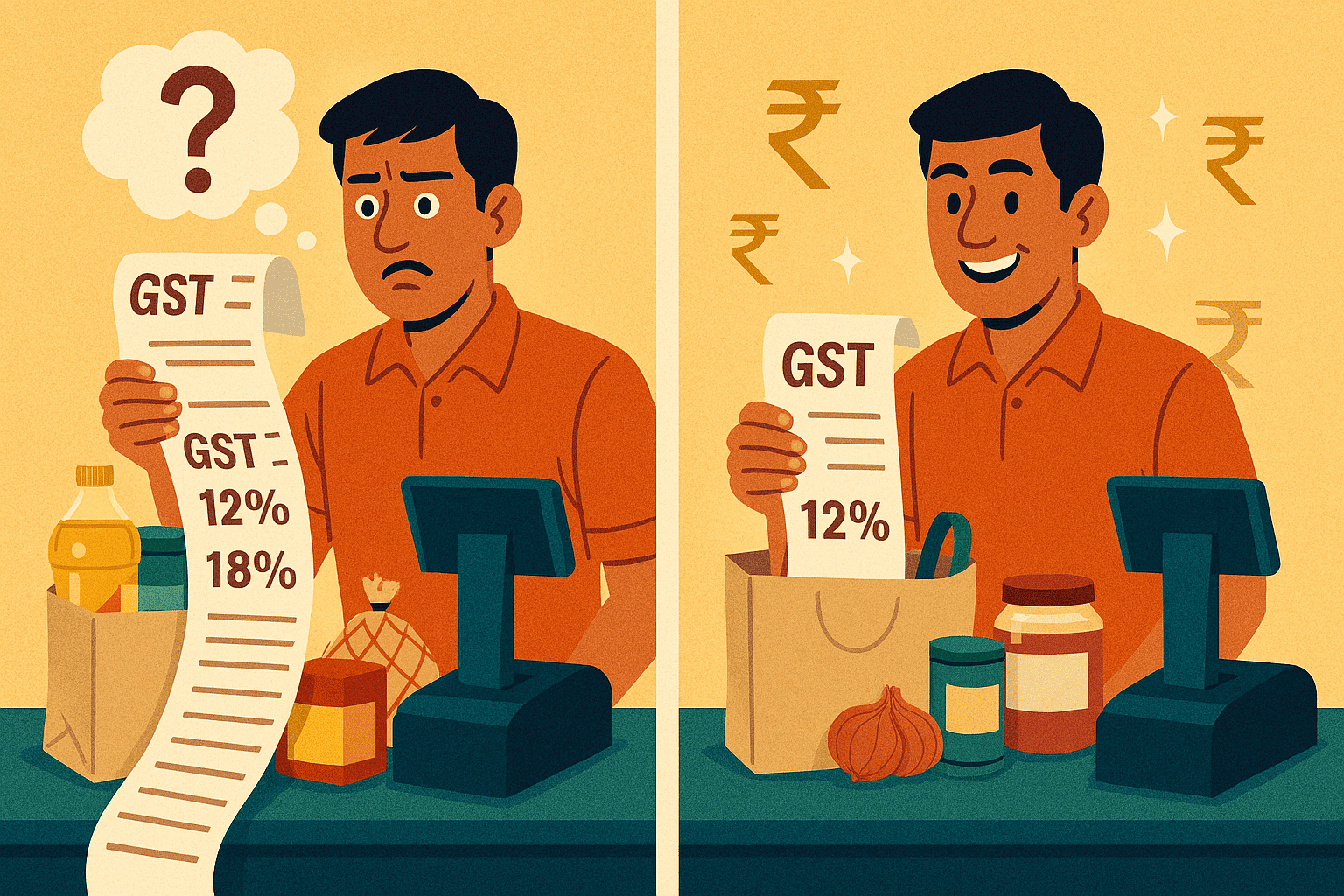

If you’re like Ravi who often gets confused when shopping online—“Why does one product have 5% GST and another 18%?”—you’re not alone. For years, India’s Goods and Services Tax (GST) has had multiple slabs, making it complex for both consumers and businesses.

But things may be changing. The buzz is around a Next-Gen GST system—one that aims to move closer to a single tax slab. Sounds interesting, right? Let’s break it down in simple terms.

Before that Explore our detailed analysis of recent GST reforms and their impact

What is GST and Why Do We Have Multiple Slabs?

When GST was rolled out in 2017, the goal was simple: replace multiple indirect taxes like VAT, excise duty, and service tax with one unified tax system.

However, to balance affordability and revenue, the government created different slabs—5%, 12%, 18%, and 28%. For example:

- 5% GST – Basic items like food grains, life-saving drugs.

- 12% GST – Processed food, certain household items.

- 18% GST – Most goods and services, like electronics, online education.

- 28% GST – Luxury cars, sin goods like cigarettes.

For Amit, a small business owner running an electronics shop, this means constantly juggling invoices, rates, and explaining GST to confused customers.

What is Next-Gen GST?

The term Next-Gen GST refers to reforms being discussed that could simplify the structure into fewer slabs—or ideally, a single slab.

Imagine this: whether you buy a washing machine, order food online, or pay for a streaming service, the tax rate could be the same. No more confusion, no more arguments with shopkeepers about “sir yeh 12% hai, woh 18% hai.”

Why This Matters for You

- Salaried Individuals (like Ravi): No mental gymnastics while budgeting—same tax rate across categories.

- Middle-Class Families: Easier to predict monthly expenses.

- Small Business Owners (like Amit): Simplified billing and compliance.

- Investors: A more transparent system improves India’s ease of doing business, which can attract foreign investment.

Challenges of Moving to a Single GST Slab

Of course, it’s not as easy as waving a magic wand.

- Revenue Concerns: High-tax items (like luxury goods) currently generate significant revenue. A single slab may reduce this.

- Fairness: Should a Mercedes and a packet of biscuits really be taxed at the same rate?

- Transition Phase: Businesses will need time to adjust billing systems and compliance software.

Think of it like shifting from paying multiple utility bills separately to one combined bill—it’s easier in the long run, but the setup takes effort.

How Will It Impact You?

Let’s take some practical scenarios:

- Rahul, a 29-year-old IT professional: When he orders food online, sometimes the GST feels higher than expected. A single slab system would remove this confusion.

- Seema, a homemaker: While planning monthly grocery shopping, she won’t have to calculate which items are taxed at 5% and which at 18%.

- Amit, the businessman: Reduced paperwork means more time to focus on customers rather than GST returns.

In short, less confusion, more clarity.

The Road Ahead

While the idea of a single GST slab is promising, experts believe India may first move towards two slabs—one lower rate for essentials and another standard rate for everything else. Gradually, this could merge into a single slab as the economy matures.

The government’s GST Council is actively reviewing this (you can follow updates on Moneycontrol and Economic Times).

FAQs on Next-Gen GST

1. Will GST become cheaper if there’s a single slab?

Not necessarily. Some items may become cheaper, but others could get costlier depending on the final slab rate.

2. How will small businesses benefit?

With fewer tax rates, compliance and filing become simpler, saving time and costs.

3. Is this happening soon?

The GST Council is studying the matter, but any change will likely be gradual to avoid disruption.

4. Will luxury goods also get the same tax rate as essentials?

In a pure single slab, yes. But in practice, India may move towards two slabs before considering a single slab.

Related Reads on iMoneyMatters.in

Conclusion

The Next-Gen GST system could truly be a game-changer for India’s tax landscape. While there are challenges, the promise of a simpler, transparent, and fairer system is exciting.

If you’ve ever scratched your head at a bill wondering “Why so many GST rates?”, you’ll definitely welcome this change.