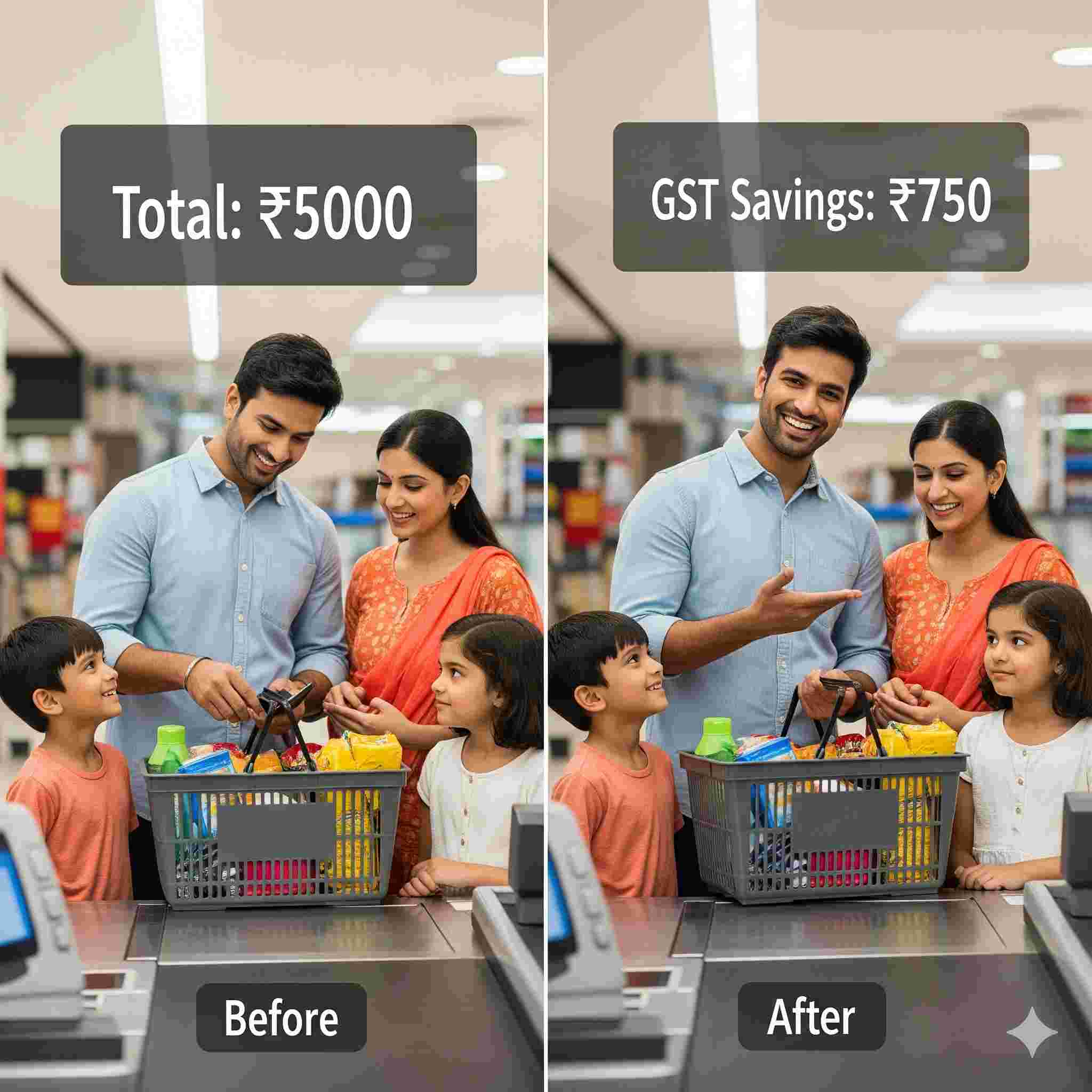

Just Imagine that You’re at the grocery store checkout, and suddenly your monthly essentials bill is ₹1,200 less than usual. Your shampoo, toothpaste, and even that packet of namkeen everything costs a bit less. Then your builder calls to say your under-construction flat just got more affordable because cement prices dropped. Sounds too good to be true? Well, welcome to GST 2.0!

Starting September 22, 2025, India’s tax system is getting its biggest makeover since 2017. The GST Council has slashed rates across hundreds of items, making everything from your bathroom essentials to building your dream home more affordable. You might be wondering – what exactly gets cheaper, and how much can your family actually save?

Let’s dive into the complete list below, because trust me, this affects every single thing you buy.

For full explanation see GST 2.0 Explained

The Personal Care Revolution: Your Bathroom Just Got Cheaper

Remember when buying a good shampoo felt like splurging? Not anymore. The GST Council has moved all personal care essentials from 18% to just 5% GST

What’s Now Cheaper in Your Daily Routine

Personal Care Items – Monthly Household Impact

| Item | Typical Price | Old GST (18%) | New GST (5%) | You Save |

|---|---|---|---|---|

| Shampoo (200ml) | ₹100 | ₹118 | ₹105 | ₹13 |

| Toothpaste | ₹50 | ₹59 | ₹52.50 | ₹6.50 |

| Hair Oil (100ml) | ₹80 | ₹94.40 | ₹84 | ₹10.40 |

| Soap (Pack of 4) | ₹60 | ₹70.80 | ₹63 | ₹7.80 |

| Toothbrush | ₹30 | ₹35.40 | ₹31.50 | ₹3.90 |

| Monthly Savings | ₹320 | ₹41.60 |

Food & Grocery Items – Weekly Shopping Impact

| Item | Typical Price | Old Rate | New Rate | You Save |

|---|---|---|---|---|

| Butter (100g) | ₹50 | 12% → ₹56 | 5% → ₹52.50 | ₹3.50 |

| Ghee (500ml) | ₹300 | 12% → ₹336 | 5% → ₹315 | ₹21 |

| Cheese (200g) | ₹150 | 12% → ₹168 | 5% → ₹157.50 | ₹10.50 |

| Namkeen (200g) | ₹40 | 12% → ₹44.80 | 5% → ₹42 | ₹2.80 |

| Chocolates | ₹100 | 18% → ₹118 | 5% → ₹105 | ₹13 |

| Paneer (250g) | ₹80 | 5% → ₹84 | 0% → ₹80 | ₹4 |

| Weekly Savings | ₹54.80 |

Electronics & Appliances

| Item | Typical Price | Old GST (28%) | New GST (18%) | You Save |

|---|---|---|---|---|

| 32″ LED TV | ₹25,000 | ₹32,000 | ₹29,500 | ₹2,500 |

| 1.5 Ton AC | ₹35,000 | ₹44,800 | ₹41,300 | ₹3,500 |

| Washing Machine | ₹30,000 | ₹38,400 | ₹35,400 | ₹3,000 |

| Small Car | ₹6,00,000 | ₹7,68,000 | ₹7,08,000 | ₹60,000 |

| Motorcycle | ₹80,000 | ₹1,02,400 | ₹94,400 | ₹8,000 |

Construction Materials – Home Building Savings

| Item | Typical Price | Old GST (28%) | New GST (18%) | You Save |

|---|---|---|---|---|

| Cement (50kg bag) | ₹350 | ₹448 | ₹413 | ₹35 |

| Paint (20L) | ₹4,000 | ₹5,120 | ₹4,720 | ₹400 |

| Marble (per sq ft) | ₹200 | 12% → ₹224 | 5% → ₹210 | ₹14 |

Healthcare Gets Biggest Relief – 0 %

| Item | Old Rate | New Rate | Impact |

|---|---|---|---|

| Health Insurance (₹15,000 premium) | 18% → ₹17,700 | 0% → ₹15,000 | Save ₹2,700 |

| Life Insurance (₹12,000 premium) | 18% → ₹14,160 | 0% → ₹12,000 | Save ₹2,160 |

| Life-saving medicines | 12% → 0% | Completely free | 12% savings |

Automobile Sector Relief

| Vehicle Type | Engine/CC | Old Rate | New Rate | Savings on ₹5L Car |

|---|---|---|---|---|

| Small Petrol Car | Under 1200cc | 28% | 18% | ₹50,000 |

| Motorcycle | Under 350cc | 28% | 18% | ₹8,000 on ₹80K bike |

| 3-Wheeler | All | 28% | 18% | ₹25,000 on ₹2.5L vehicle |

Education Becomes Free from GST

| Item | Old Rate | New Rate | Impact |

|---|---|---|---|

| Exercise Books | 12% | 0% | Completely tax-free |

| Notebooks | 12% | 0% | Completely tax-free |

| Pencils & Erasers | 12%/5% | 0% | Completely tax-free |

| Maps & Charts | 12% | 0% | Completely tax-free |

Student savings: A family spending ₹2,000 on stationery will save ₹240-360 annually.

Agriculture Equipment Relief

| Equipment | Old Rate | New Rate | Savings on ₹5L Tractor |

|---|---|---|---|

| Tractors | 12% | 5% | ₹35,000 |

| Drip Irrigation | 12% | 5% | ₹7,000 on ₹1L system |

| Sprinklers | 12% | 5% | ₹3,500 on ₹50K system |

Items That Became More Expensive (40% GST)

| Item | Old Rate | New Rate | Impact |

|---|---|---|---|

| Luxury Cars | 28% | 40% | 12% increase |

| Tobacco Products | 28% | 40% | 12% increase |

| Aerated Drinks | 28% | 40% | 12% increase |

Looking at the Bigger Picture

GST 2.0 isn’t just about individual savings – it’s a strategic economic move. With external trade pressures and the need to boost domestic consumption, the government is putting money back in consumers’ pockets right before the festive season.

Conclusion

From the shampoo in your bathroom to the cement in your dream home, GST 2.0 is delivering real relief to Indian families. The shift from four tax slabs to just two main ones (5% and 18%) makes everything simpler and, more importantly, makes daily life more affordable for the common person.

Whether you’re a young professional starting your career, a middle-class family managing monthly expenses, or someone planning to build a home, these changes put money back in your pocket. The government estimates that for a typical household, this could mean savings of ₹15,000-25,000 annually – that’s a month’s groceries for free!

The real winners are India’s middle class and small businesses, who get both immediate relief and a simpler tax system to navigate.