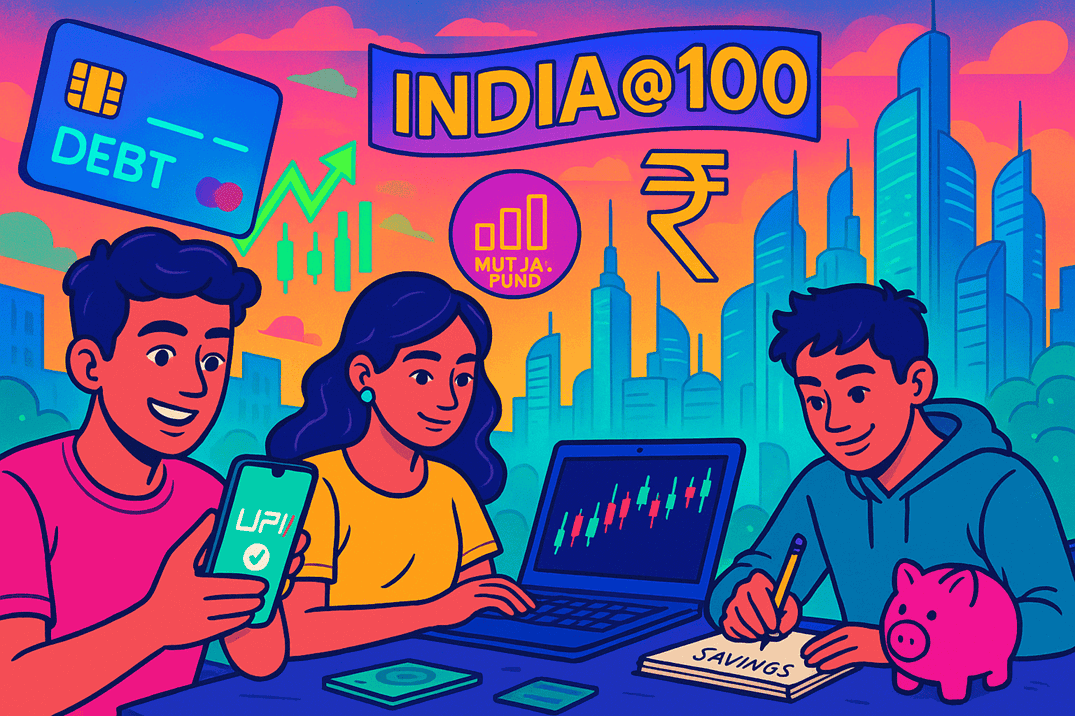

SEBI’s Game-Changing Move: How New Incentives Are Opening Doors for First-Time Women Investors in Mutual Funds

You know what? Just when I was discussing mutual fund investments with my friend Priya last week, she mentioned how intimidating the whole process seemed to her. She’s a marketing manager in Pune, earns well, but has been sticking to traditional savings accounts and fixed deposits. Well, I’ve got some exciting news for women like … Read more