If you’re a salaried employee in India, chances are that a small portion of your salary disappears every month into something called the Employee Provident Fund (EPF). You might have even noticed it on your payslip as a deduction. But have you ever wondered — Where exactly is this money going? How much will you really get when you retire? Can you withdraw it early if you need it?

Let’s break it down with a relatable example.

Ravi, 32, works in Bangalore and earns ₹30,000 per month. Every month, a part of his salary (12% basic pay) goes into EPF, and his employer contributes an equal amount. Over the years, this slowly grows into a significant retirement corpus. But like many young professionals, Ravi wondered: “Should I just leave my EPF untouched until 58, or can I use it for emergencies like buying a house?”

If you’ve had similar thoughts, this guide will answer all your questions about EPF in 2025.

What Exactly is Employee Provident Fund (EPF)?

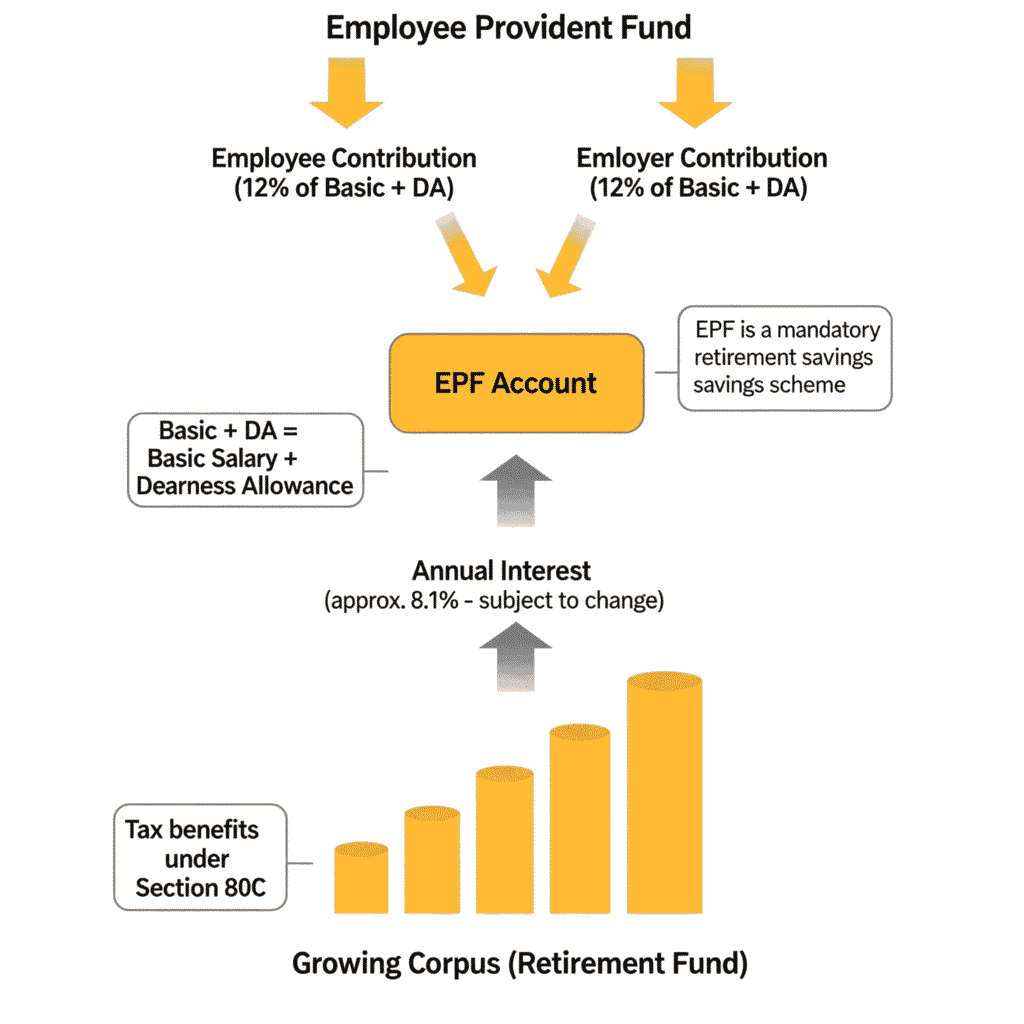

Think of EPF as a government-backed scheme that you and your employer fill together every month. Established under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, it’s one of India’s oldest and most trusted retirement schemes.

Here’s how it works: Every month, 12% of your basic salary gets automatically deducted and deposited into your EPF account. The best part? Your employer also contributes an equal amount on your behalf. So if you’re contributing ₹3,000 monthly, your employer adds another ₹3,000, making it ₹6,000 total!

Current EPF Interest Rate for 2025: The government has set the EPF interest rate at 8.25% per annum for FY 2024-25, which is significantly higher than most bank savings accounts.

EPF Eligibility and Rules: Who Can Join?

Mandatory Coverage:

- All organizations with 20 or more employees must register for EPF

- Employees earning up to ₹15,000 per month are mandatorily covered

Voluntary Coverage:

- Companies with fewer than 20 employees can voluntarily join

- Employees earning more than ₹15,000 can also opt for EPF with employer agreement

Real-life Example: Meera works at a startup in Bengaluru with only 15 employees. Even though EPF isn’t mandatory for her company, her employer decided to provide this benefit voluntarily. Now she enjoys the same retirement security as employees in larger organizations.

EPF Contribution Breakdown: Understanding the Math

This is where it gets interesting. Let’s say Amit earns ₹40,000 as basic salary. Here’s how his EPF contribution works:

Employee’s Share (12%): ₹4,800 per month

- This entire amount goes directly to his EPF account

Employer’s Share (12%): ₹4,800 per month

Additional Employer Costs:

Special Cases with Reduced Rates (10%):

- Companies with fewer than 20 employees

- Sick industrial units

- Specific industries like jute, beedi, brick, coir, and guar gum factories

Benefits of EPF in 2025

Safe & Risk-Free Returns

Unlike mutual funds or the stock market, EPF is backed by the government — so your capital remains safe. Perfect for middle-class families who want security.

Tax Benefits

- Your contribution qualifies for deduction under Section 80C up to ₹1.5 lakh.

- Interest earned is tax-free till 2.5 lakh deposit limit.

Retirement Corpus

By the time you retire, your EPF can become quite large. For instance, if Rahul (28, working in Mumbai) keeps contributing ₹8,000 per month for 30 years, his corpus can accumulate huge corpus – thanks to compounding. See Investment Calculator

Emergency Withdrawals

Life happens. You may need money for a house down payment, child’s education, or medical emergency. EPF allows partial withdrawals for such needs after meeting certain conditions.

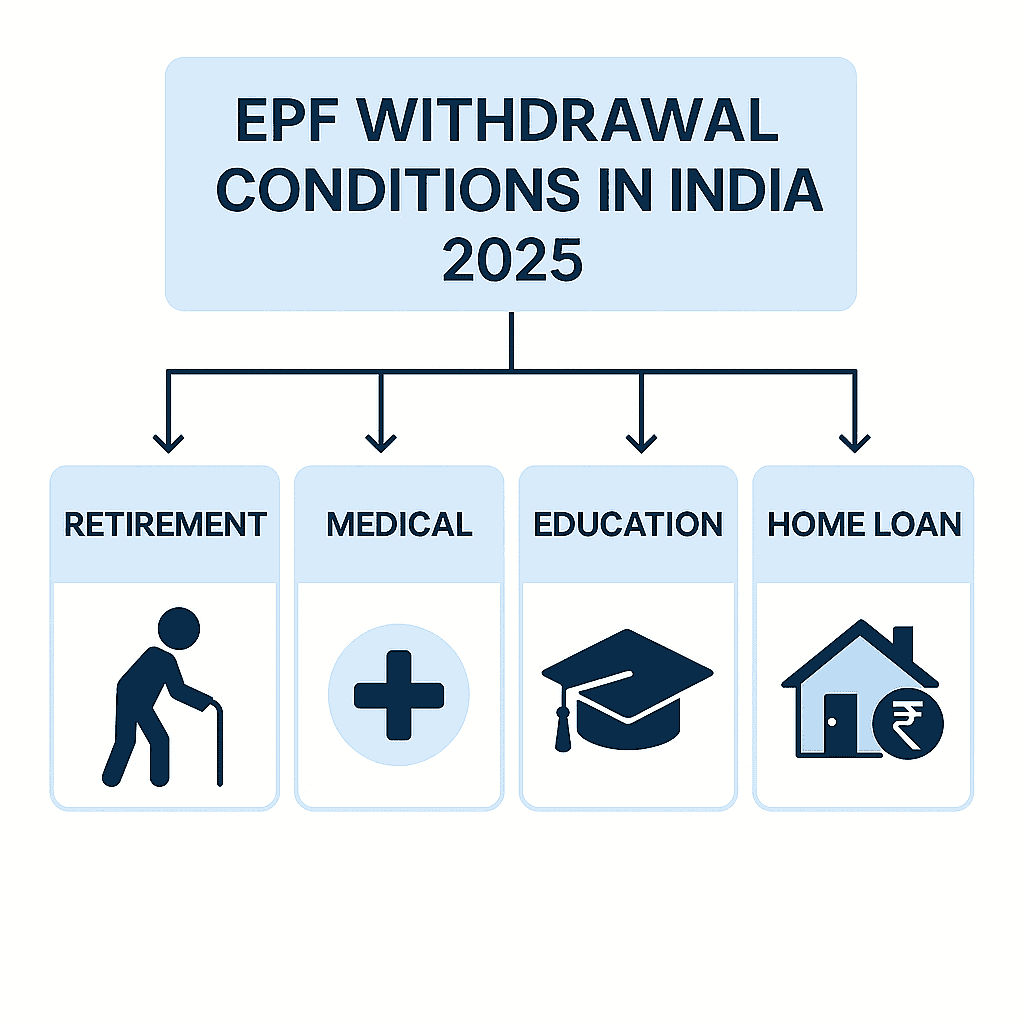

EPF Withdrawal Rules: When and How Much Can You Withdraw?

EPF withdrawal rules have become more flexible in 2025. Let me explain the different scenarios:

Complete Withdrawal (100%)

Retirement: You can withdraw your entire EPF balance once you turn 58 years old or retire

Unemployment:

- After 1 month of unemployment: Withdraw up to 75% of your balance

- After 2 months of unemployment: Withdraw the remaining 25%

Partial Withdrawal for Specific Purposes

Employee Pension Scheme (EPS): Your Monthly Pension After Retirement

Here’s something many people don’t realize – part of your EPF contribution automatically goes toward securing a monthly pension for life after retirement through the Employee Pension Scheme (EPS).

How EPS Works:

- 8.33% of your employer’s contribution goes to EPS (maximum on ₹15,000 salary)

- You become eligible for pension at age 58

- Current minimum pension: ₹1,000 per month (government is considering increasing this to ₹7,500)

Pension Calculation Formula:

Monthly Pension = (Average salary of last 60 months × Years of service) ÷ 70

Real Example: Sunita worked for 25 years with an average salary of ₹25,000 in her last 5 years. But monthly salary is capped by EPFO to 15000. So ideally the Her monthly pension would be: (₹15,000 × 25) ÷ 70 = ₹5357 per month for life.

UAN (Universal Account Number): Your EPF Digital Identity

Every EPF member gets a 12-digit Universal Account Number (UAN) that stays with you throughout your career, regardless of job changes.

UAN Benefits:

- Single account for multiple jobs

- Online access to EPF services 24/7

- Easy transfer of EPF balance between jobs

- Transparent tracking of all contributions

How to Activate Your UAN

Step 1: Visit the EPFO member portal: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Click on “Activate UAN”

Step 3: Enter your UAN, Member ID, Aadhaar number, and PAN

Step 4: Fill in personal details and get authorization PIN on mobile

Step 5: Enter PIN and complete activation

EPF Tax Benefits and TDS Rules 2025

EPF offers excellent tax benefits, but recent changes have introduced some important considerations:

Tax Benefits:

- EPF contributions up to ₹1.5 lakh qualify for Section 80C deduction

- Interest earned is tax-free (with conditions)

- Maturity amount is completely tax-free if withdrawn after 5 years of continuous service

New TDS Rules (Applicable from April 2021):

If your annual EPF contribution exceeds ₹2.5 lakh, then:

- Interest on excess contribution becomes taxable

- 10% TDS if PAN is linked (20% if not linked)

- Interest on contribution up to ₹2.5 lakh remains tax-free

Example: Raj contributes ₹4 lakh annually to EPF. Interest on ₹2.5 lakh is tax-free, but interest on the remaining ₹1.5 lakh will attract 10% TDS.

Frequently Asked Questions

Q1: Can I withdraw my EPF if I’m switching jobs?

No, you cannot withdraw EPF just for job changes. However, you can transfer your EPF balance to your new employer’s account using your UAN. If you remain unemployed for more than 2 months, then you can withdraw the full amount.

Q2: What happens to my EPF if I leave India permanently?

You can withdraw your entire EPF balance if you’re settling abroad permanently. You’ll need to submit Form 19 along with proof of emigration and passport copies.

Q3: Can I increase my EPF contribution beyond 12%?

Yes, you can contribute more than 12% through Voluntary Provident Fund (VPF), but your employer’s contribution remains at 12%. The excess contribution also earns the same EPF interest rate.

Q4: How do I check my EPF balance?

You can check your EPF balance online through the EPFO member portal using your UAN, via SMS by sending “EPFOHO UAN” to 7738299899, or through the UMANG mobile app.

Q5: What if my employer doesn’t contribute to EPF regularly?

This is illegal. You can file a complaint with EPFO’s grievance portal or contact your regional EPF office. The employer can face penalties and legal action for defaulting on EPF contributions.

Q6: Can I get a loan against my EPF balance?

EPF doesn’t offer loans, but you can make partial withdrawals for specific purposes like home purchase, medical emergency, or education after meeting the service requirements.

The Bottom Line

EPF is more than just a deduction from your salary – it’s your financial security blanket for the future. With its combination of guaranteed returns, tax benefits, employer matching, and pension provisions, EPF offers a comprehensive retirement solution that’s hard to beat.

The key is to start early, contribute regularly, and understand the rules to make the most of this fantastic scheme. Remember, the money you’re setting aside today will provide the foundation for a comfortable retirement tomorrow.

Take action now: If you haven’t activated your UAN yet, do it today. Check your EPF balance regularly and ensure all your previous jobs’ EPF accounts are merged. Your future self will thank you for being proactive about your EPF management.

Share this guide with colleagues, friends, or family members who are just starting their careers or anyone who wants to understand EPF better. Knowledge about EPF is one of the best gifts you can give to someone planning their financial future.

Coming up next: “PPF vs EPF vs NPS: Which Retirement Option Gives Maximum Returns?” – We’ll compare all three major retirement planning tools and help you decide the optimal combination for your age and income.

External Reference Links:

- EPFO Official Website

- EPF Withdrawal Rules – ClearTax

- UAN Services Portal

- Tax on PF interest over ₹2.5 lakh (CBDT Rule 9D)

Related Articles to Explore on imoneymatters.in:

- Ultimate Guide to Salary Negotiation in India

- Tax-Saving Investments Under Section 80C: Complete List

- Building Your Emergency Fund: How Much is Enough?

- Mutual Fund SIP vs Bank FD: Better Returns Comparison

- EPF vs PPF vs NPS: Which should you prioritize?

- PPF vs Debt Mutual Funds for salaried investors

- Step-by-step: Activate UAN, update KYC & e-nomination

- EPF interest rate history: 1993–2025

- NPS tax benefits under 80CCD(1B) and employer 80CCD(2)

Disclaimer

The content on iMoneyMatters.in is for educational and informational purposes only. It should not be considered as financial, investment, or tax advice. Readers are advised to do their own research and consult a SEBI-registered financial advisor before making any investment decisions